Branded Residences across Phuket a growing market

Branded Residences across Phuket a growing market

Property developers across Phuket and the whole of Thailand are increasingly attracted by hotel branded residences

New reports states that between 2018 and 2020 new completed units will represent a massive 83% increase over existing supply.

Property developers across Thailand are experiencing are increasingly attracted by hotel branded residences in order to spur price premium points and buyer demand.

Currently there are 29 new hotel residence projects countrywide with nearly 90% of these located in resort areas.

New research by consulting group C9 Hotelworks has pinpointed that the top 3 locations for completed and pipeline projects in their Southeast Asia Hotel Residences Market Trends report are Phuket (26 properties), Pattaya (10 properties) and Bangkok (9 properties).

With nearly 100 mainstream hotel residence projects and over 21,000 units completed, the next three years will see sector boldly expanding into new territory.

The reports states that between 2018 and 2020 new completed units will represent a massive 83% increase over existing supply.

Branded Residences across Phuket a growing market

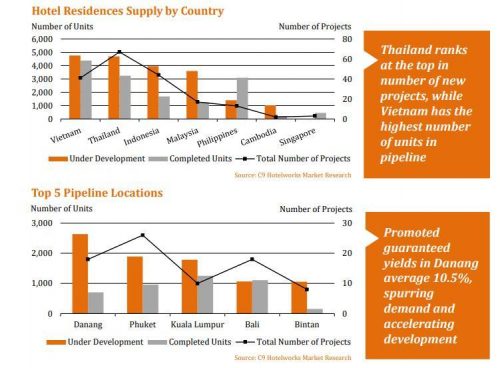

Viewing how Thailand ranks in terms of competitiveness in the sector, with 41 completed projects to date, this accounts for 41% of the regions supply that stands at over 21,000 hotel residence units.

The country ranks first in Southeast Asia as an urban trend is shifting back to resort areas. Indonesia follows, whilst the rising star is Vietnam with Danang featured as a favored developer’s marketplace.

In Thailand, Phuket with 13 completed projects and another 13 in the works has a longstanding legacy of hospitality-led residences in such well-known ultra-luxury resorts as Amanpuri, Banyan Tree and Sri Panwa.

Though over the past few years Bangkok’s Chao Phraya River with marquee branded projects affiliated to the likes of global icons Four Seasons and Mandarin Oriental have pushed prices though the glass ceiling to an average of more than THB315,000 per square meter, while the national average selling price in the sector is just over THB101,000.

Linking the connection to brands and pricing premiums, C9 research across all the markets in the country show a demonstrated brand premium between 15-20%. Taking a close look at existing supply 92% of the supply are brand affiliated and we expect this preference by developers and property buyers to continue.